Establish how many products your company produces in 1 month, then divide your total mounted costs by the number of models per thirty days to find your common fastened value. Mounted value, along with variable price, constitutes the total enterprise expense. Variable costs are production expenses that fluctuate relying on a company’s production or gross sales volume. For example, variable prices decrease when a company’s manufacturing unit produces fewer models and uses fewer raw supplies. Understanding the whole mounted costs of your corporation will help you with budgeting and pricing. This is particularly so if you are ready to calculate the common fixed value, which is the mounted value per unit.

These brief tern fastened prices are typically straightforward to price range for as it is not going to change regularly. Businesses depend on short-term fastened prices to plan their day-to-day operations and maintain steady monetary administration. Average fixed prices are the total mounted costs paid by an organization, divided by the number of units of product the corporate is currently making. In enterprise, the time period “variable costs” refers to these expenses that change regarding the amount of goods or services produced.

Examples are month-to-month rental paid for lodging, salary paid to an worker, etc. Nevertheless, please note that such price is not permanently fastened but changes over time. In the income statement, mounted costs are subtracted from gross revenue to find out the operating profit (or EBIT – Earnings Before Interest and Taxes).

Analyzing and evaluating fixed and variable expenses helps companies guarantee their companies’ financial well-being and profitability. Study tips on how to apply mounted and variable enterprise costs in this part. Dedicated fixed prices or capability prices are multiyear monetary obligations firms bear to maintain their manufacturing capability. These costs stay unchanged as businesses can’t keep away from them while using their existing manufacturing capabilities to create and promote merchandise. Imagine a enterprise spends ₹ 5,000 value of fixed expenses to provide 1,000 pens on the per unit cost of ₹ 5. If they decide to make 2,000 pens, the fee per unit reduces to ₹ 2.5, and that happens as a outcome of the mounted business price doesn’t fluctuate with production volume.

The greater the fixed costs, the upper the break-even level might be. This is because fastened costs do not change regardless of the variety of items bought. Hence, a enterprise needs to generate sufficient revenue from sales to cover these prices. As a outcome, when fixed costs increase similar to as a end result of larger rent, salaries, or insurance, the enterprise should sell extra units or generate more income to interrupt even. Understanding and managing your fixed costs is crucial for your corporation’s financial well being.

- To discover the marginal value for a given amount, just substitute the value for Q into each expression.

- If you employ insurance coverage, you may have to pay for coated services to meet a deductible, however the premiums won’t change unless you get a model new policy.

- Accountants use amortization to unfold out the costs of an asset over the helpful lifetime of that asset.

- This discount in per-unit fixed costs permits the company to produce goods extra effectively and at a decrease value per unit.

Disadvantages Of Fixed Prices

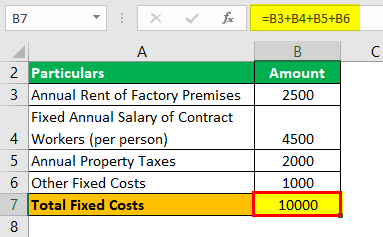

Your business’ total fixed monthly costs (rent, utilities, payments, salaries, taxes) total $30,000. You sell delicate drink products to your area, and the prices of supplies and distribution (your variable costs) are $0.60 and also you promote your products for $2.50. In explicit, should you can calculate the average fastened value, it is possible for you to to find out the mounted price per unit. This common fixed price can be an quantity it costs to provide the unit or service, no matter how many are sold. All expenses which are mounted, when added together, allow you to arrive at the sum whole of fastened costs for a enterprise. For occasion, if you incur hire, salaries, curiosity bills https://www.quickbooks-payroll.org/ and depreciation, you add all these to get your corporation’s total mounted prices.

Mr. Hari Lal Ltd. must compute the typical mounted cost to establish the suitable pricing per doll. Now, we are in a position to plug those numbers into our AFC method to calculate the common fastened value per widget. Businesses have many prices they should think about when trying to make a profit. One of an important ideas to know is the distinction between fastened and variable prices. Don’t stress if you do not clearly understand the concept of the 2 and the difference between them. As Soon As you know the whole fixed value of your business, you should use that data in various methods.

Functions Of The Breakeven Level

As such, it is very important perceive the idea of fastened belongings as it might be essential in attaining profitability targets. Let us take the instance of firm ABC Ltd, a toy manufacturing unit. According to the manufacturing supervisor, the variety of toys manufactured in April 2019 is 10,000. The whole value of production for that month as per the accounts division stood at $50,000. Calculate the fastened price of manufacturing if the variable price per unit for ABC Ltd is $3.50. On the opposite hand, variable costs are related directly to the production of goods and companies in the enterprise.

For example, the entire fastened price will assist with budgeting and pricing. When you handle a enterprise, it’s essential to keep monitor of expenses. Your revenue subtracted by your expenses gives you your internet profit, an important measure of how issues are going. Your bills may be damaged down into two major classes — fixed value and variable cost. While some mounted prices are essential, others may be lowered or eliminated by way of strategic choices, corresponding to shifting to remote work to keep away from office lease.

Making business choices requires an understanding amongst which costs are mounted and which costs are variable. Mounted value represent bills that stay fixed regardless of modifications in production or gross sales levels. Since mounted costs should be paid no matter business efficiency, they create a baseline for financial planning. Companies should factor in these prices when developing budgets to ensure that they have enough revenue to cowl them. Failure to properly account for fastened costs can result in cash move issues. This is as a result of these expenses don’t fluctuate with demand or gross sales, and must be paid consistently even in periods of low gross sales.

Fixed costs are important when deciding whether or not to close down operations temporarily, as they should be paid even when production halts. In reality, small enterprise owners report an absence of monetary literacy, inflicting them to lose an average of $118,121 in revenue. Jami Gong is a Chartered Professional Account and Monetary System Marketing Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of experience embrace accounting system and enterprise resource planning implementations, in addition to How To Calculate Fixed Cost With Examples accounting enterprise course of improvement and workflow design. Jami has collaborated with purchasers large and small in the know-how, monetary, and post-secondary fields.